- The impressive performance reflects CYTD’s 41% gain in 2024, AHL says.

- Analysts say PSX is now the fourth-highest-performing stock market in the world.

- The automobile, banking, cement and energy sectors witnessed heavy purchasing operations.

On Thursday, stocks reached an intraday high of more than 89,000 points with strong investor interest in interest rate-sensitive sectors, anticipating a significant easing of monetary policy at the central bank’s upcoming gathering due to the generally upbeat economic outlook.

The PSX’s main KSE-100 index rose 1,246.81 points, or 1.74%, to 89,100 points at 02:04 p.m., up from the previous close of 87,194.53 points.

With the first quarter (1QFY25) corporate results coming in, investors have focused their attention on high-performing sectors such as automobile and cement manufacturers, commercial banks, oil and gas exploration and marketing, and power generation.

talk to Geo.tv“The PSX has risen since the approval of a $7 billion International Monetary Fund (IMF) loan under the 37-month Extended Fund Facility (EFF),” said Saad Ali, Research Director at Intermarket Securities.

He said recent political developments, such as the passage of the 26th Amendment to the Constitution, gave it an additional impetus.

“Right now, expectations of a 200 basis point interest rate cut are fueling the rally further,” Ali added.

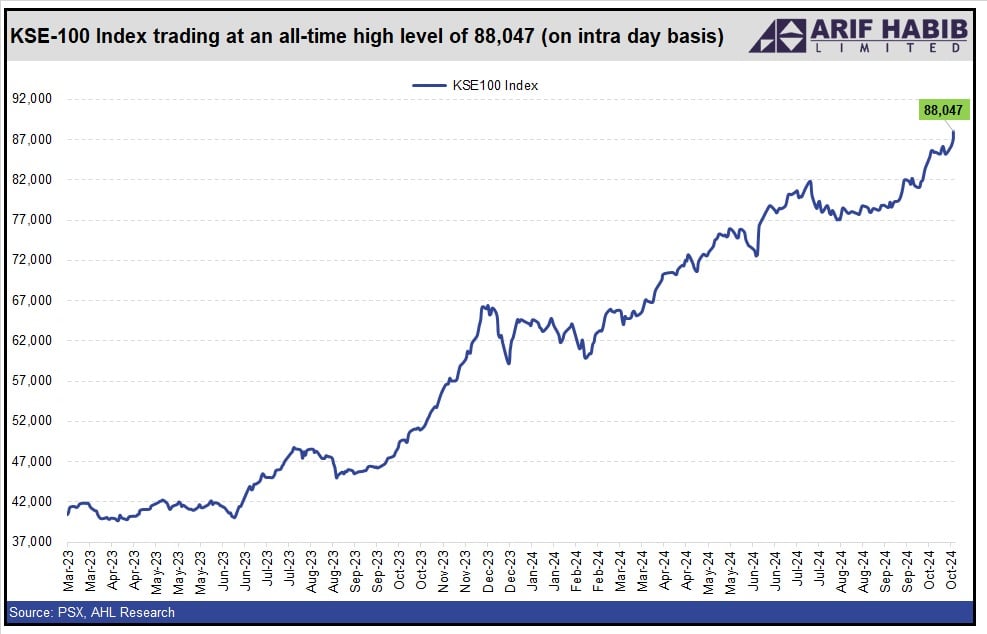

The KSE-100 index crossed the 88,000-point level and is “trading at an all-time high,” brokerage firm Arif Habib Limited (AHL) said in a note.

“This impressive performance reflects a 41% gain in CYTD (YTD) in 2024 and a monthly increase of 8.5% – making PSX the fourth highest-performing equity market in the world,” the brokerage said. He said.

The State Bank of Pakistan’s Monetary Policy Committee (MPC) is scheduled to cut interest rates by 200 basis points at its meeting on November 4, 2024, as inflation has declined steadily in recent months.

Speculation has been swirling around a rate cut of up to 400 basis points by December, and according to analysts, there is scope for policy easing, which has also revived foreign investors’ interest in the country’s capital market.

Inflation fell to 6.9% year-on-year in September 2024, the lowest level since January 2021, down from 9.6% in August, driven by a higher base effect, facilitating commodity and energy markets, and a stable currency, according to the PBO. Statistics (PBS).

In September, the Reserve Bank of Australia cut its key interest rate by 200 basis points to 17.5% from 19.5%, citing a sharp decline in both headline and core inflation over the past two months.

This is a developing story and will be updated with more details.