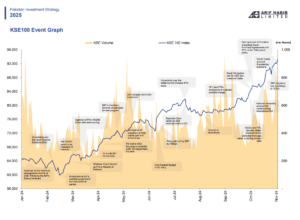

The KSE-100 index, Pakistan’s index of stock market performance, is expected to reach 120,010 points by December 2025, according to Arif Habib Limited (AHL)’s latest report titled ‘Pakistan Investment Strategy 2025’.

This expected growth indicates a return of 27% over the next 13 months, driven by stabilizing macroeconomic fundamentals and an undervalued stock market.

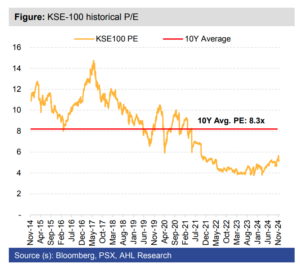

“Current market dynamics, coupled with easing interest rates and exchange rate stability, provide an ideal environment for stocks to outperform,” the report stated. AHL highlights that the KSE-100 index is trading at a P/E multiple of 5.3, well below its 10-year average of 8.3, suggesting room for a rerating.

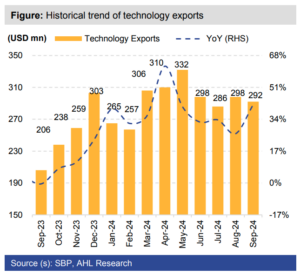

The report also notes that despite strong returns of 52% in 2024, the KSE-100 remains undervalued across various valuation metrics. “Even with 2024 returns, the Pakistani market offers great potential for growth,” AHL adds. Sectors such as technology and oil marketing companies are expected to lead earnings growth with expected increases of 39.3% and 39.1%, respectively, for fiscal year 2025.

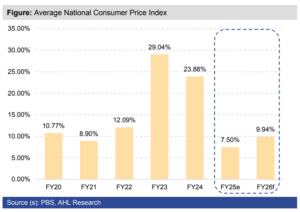

AHL emphasizes improving macroeconomic indicators, including GDP growth expected at 2.4% for fiscal year 2025 and inflation expected to fall to 7.5%. These conditions, coupled with low interest rates and a manageable current account deficit, are creating favorable conditions for stocks. The report notes that “the stage is set for a potential market reclassification.”

However, challenges such as political instability, commodity price volatility, and macroeconomic imbalances during the IMF program are major risks. The report also indicates a slowdown in corporate profit growth of 4.2% for 2025, the lowest level since the pandemic year 2020.

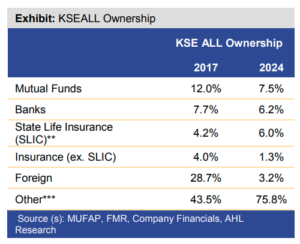

The AHL report highlights a shift in market ownership, with high net worth individuals, brokers and corporations now owning 76.4% of KSE-100 free float shares. “With 1% of fixed income reallocated to equities, mutual funds could deploy nearly Rs 30 billion in the market,” the report says, underscoring the role of domestic liquidity in boosting investor confidence.

Concluding its report, AHL maintains a positive outlook, citing monetary policy easing, a stable Pakistani rupee and potential foreign direct investment as catalysts for sustainable equity performance.