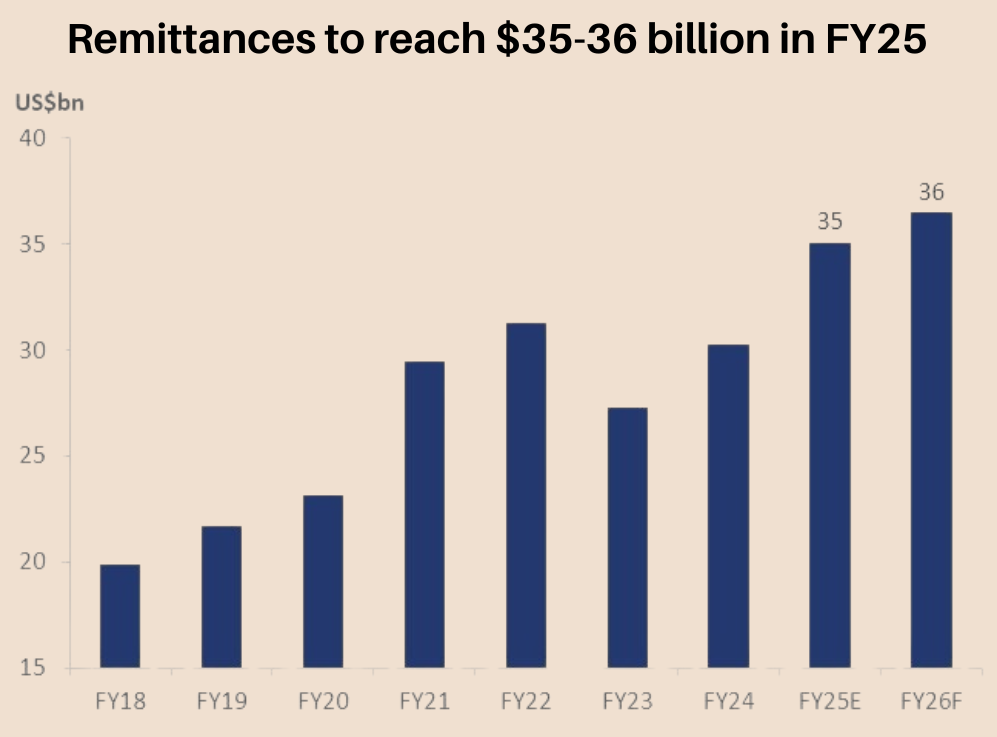

Remittances sent by Pakistanis working abroad are expected to reach $35-36 billion by the end of the current fiscal year 2024-25, according to data compiled by Topline Securities.

This would be a 16% year-on-year increase from incoming remittances during the previous fiscal year 2023-2024. According to data from the State Bank of Pakistan (SBP), workers’ remittances reached $30.3 billion by the end of the last fiscal year.

Worker remittances rose by 24% year-on-year to reach $3.052 billion in October 2024, from $2.463 billion in the same month last year.

Remittances continue to play a pivotal role in strengthening Pakistan’s external account and stimulating economic activity, while also supplementing the income of households that rely on these funds. In its latest report, “Migration and Development Brief 40,” the World Bank expected Pakistani labor flows to reach nearly $30 billion in 2025.

However, Topline Securities said remittances are expected to reach $35-36 billion. This strong momentum is due to the stability of the Pakistani rupee and the rise in labor exports over the past two or three years.

Official data released by the Overseas Immigration and Employment Bureau reveals that nearly 10 million Pakistanis have migrated over the past 17 years. Since 2022, the migration rate of highly skilled professionals has risen to 5%, up from the previous rate of 2%, while the proportion of highly educated migrants has remained constant at 3%.

Over the past two years (2022-2023), the majority of migrants were laborers, with 37% classified as skilled workers and 46% as unskilled workers.

Foreign worker remittances grew by 35% year-on-year to $11.8 billion in the first four months (July-October) of the 2024-25 fiscal year, driven by strong growth in the UAE, Saudi Arabia and UK markets by 56%, 37% and 39% on straight.

From the UAE, inflows increased by 10% month-on-month, reaching $620.9 million, with a jump of 31% compared to October 2023.

Flows from the UK amounted to $429.5 million, showing a slight increase of 1% compared to September and an improvement of 30% year-on-year.

Remittances from the European Union saw a slight decrease month-on-month, reaching $359.1 million, while flows from the United States reached $299.3 million, reflecting an 8% increase.

This growth in labor flows is due to exchange rate stability, narrowing the gap between open market rates and interbank interest rates, expanding digital payment options, and an increase in workers moving abroad, especially to the Gulf Cooperation Council countries.