Global arms sales of the top 100 companies reached $632 billion in 2023, representing a 4.2% increase in real terms compared to 2022, according to data from the Stockholm International Peace Research Institute (SIPRI).

Arms revenues rose in all regions, with notable growth among companies in Russia and the Middle East. Small arms producers have been particularly effective in responding to growing global demand, driven by conflicts in Gaza and Ukraine, rising tensions in East Asia, and rearmament programs elsewhere.

The SIPRI Top 100 list saw a significant increase in production in 2023, reversing the decline seen in 2022. Nearly three-quarters of the companies on the list recorded year-over-year revenue growth, and the majority of these gains came from companies in the bottom half of Global rankings.

“There was a noticeable rise in arms revenues in 2023, and this is likely to continue in 2024,” said Lorenzo Scarazzato, a researcher at SIPRI. He added that current revenue numbers still do not fully reflect the volume of global demand, and the start of recruitment campaigns by many companies indicates optimism for continued growth.

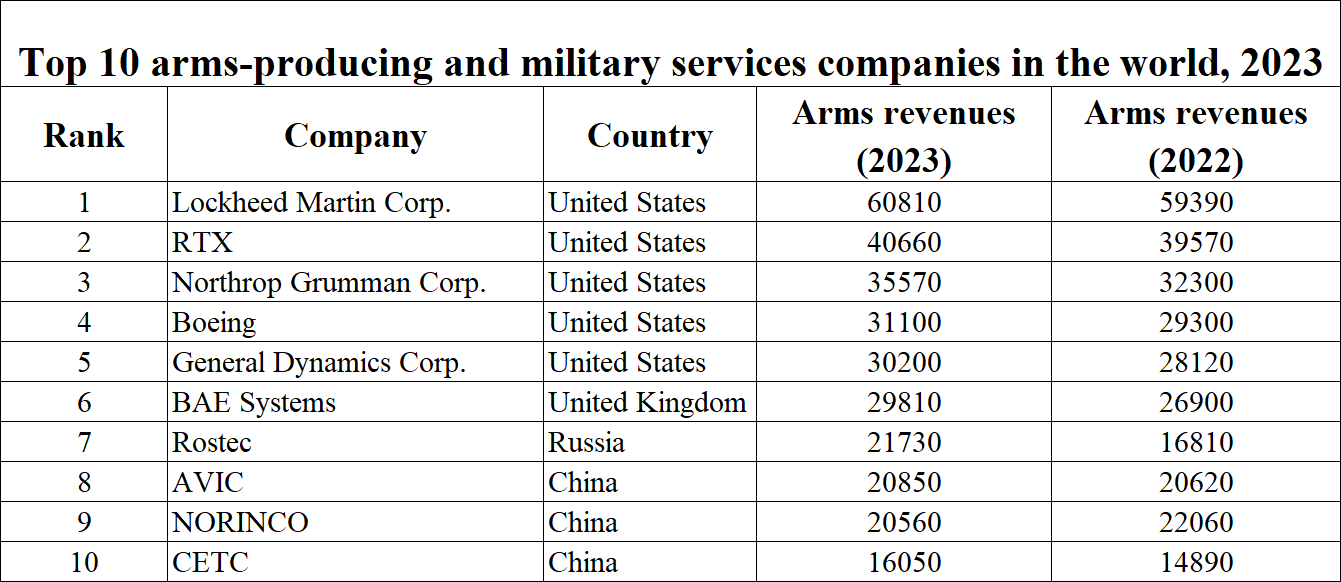

The United States continues to dominate global arms sales, with its 41 companies in the top 100 generating revenues of $317 billion, representing 50% of the total and a 2.5% increase from 2022. The five largest arms companies in the world, including That’s Lockheed Martin and RTX, all based in the United States.

However, while the 30 US companies reported growth, Lockheed Martin and RTX saw revenue declines due to supply chain disruptions, especially in aerospace and missile production. Dr. Nan Tian, Director of SIPRI’s Military Expenditure and Arms Production Program, attributed the challenges to the complexity of multi-level supply chains, which left these major companies vulnerable.

European companies in the top 100, excluding Russia, recorded $133 billion in combined revenue, an increase of just 0.2% compared to 2022. This was the smallest regional growth worldwide.

Companies producing complex weapons systems often operate under outdated contracts, delaying their ability to capitalize on increased demand. Despite this, companies that focused on ammunition and artillery production, especially those in Germany, Sweden and Poland, saw significant growth.

For example, the German company Rheinmetall expanded its production of 155 mm ammunition and increased its revenues through the delivery of Leopard tanks and war-related “circular exchange” programs.

Russian companies recorded one of the largest regional increases in arms revenue, with the two companies in the top 100 seeing a 40% rise to $25.5 billion. Rostec, a state-owned holding company, reported a 49% increase in revenue, driven by production of combat aircraft, drones and munitions as the war in Ukraine intensifies.

Although official Russian data is still scarce, analysts widely agree that production will expand significantly in 2023.

In Asia and Oceania, the 23 companies in the top 100 saw their arms revenues grow by 5.7% year-on-year, to $136 billion. The four South Korean companies recorded a combined increase in revenues of 39%, reaching $11 billion, while the five Japanese companies recorded a 35% increase, reaching $10 billion.

Japan’s military buildup since 2022 has led to an increase in domestic orders, with some companies reporting an increase in new orders of more than 300%. South Korean companies are also expanding into global markets, especially Europe, as demand related to the war in Ukraine grows.

The Middle East has seen significant growth in arms revenues, with six companies in the top 100 generating $19.6 billion in 2023, an increase of 18%. Israeli companies’ revenues reached $13.6 billion, the highest level ever recorded by Israeli companies in the SIPRI Top 100 list.

Meanwhile, Turkish companies recorded a 24% increase, with revenues reaching $6 billion, supported by exports and government initiatives that encourage self-reliance in weapons production.

Other notable developments include a 0.7% increase in revenues of the nine Chinese companies in the top 100, the smallest growth since 2019. The combined arms revenues of the three Indian companies rose by 5.8% to $6.7 billion.

Taiwan’s NCSIST reported a 27% increase in arms revenues, to $3.2 billion. The Turkish company Baykar, the main producer of drones widely used in Ukraine, announced a 25% increase in its revenues to reach $1.9 billion, with exports representing 90% of its revenues.

In the United Kingdom, the Atomic Weapons Corporation reported the largest year-on-year percentage increase among British companies in the top 100, with revenues rising 16% to $2.2 billion.

The Arms Industry Database, established in 1989, contains data for companies from 2002 to 2023, and includes information on companies in China and Russia. Revenues in this dataset are based on military sales and services to domestic and international customers, expressed in constant 2023 US dollars.

This report is part of SIPRI’s lead-up to its flagship yearbook, due to be published in 2025.