The warning is slipped due to the potential withdrawal of Washington from international institutions, including the International Monetary Fund and the World Bank, with US Treasury Secretary Scott Payet not appearing in the G20 meetings to anxiety. So what is the International Monetary Fund and the World Bank and what happens if the United States retracts them?

The United States and its allies formed institutions in the ashes of World War II to encourage global integration and future wars.

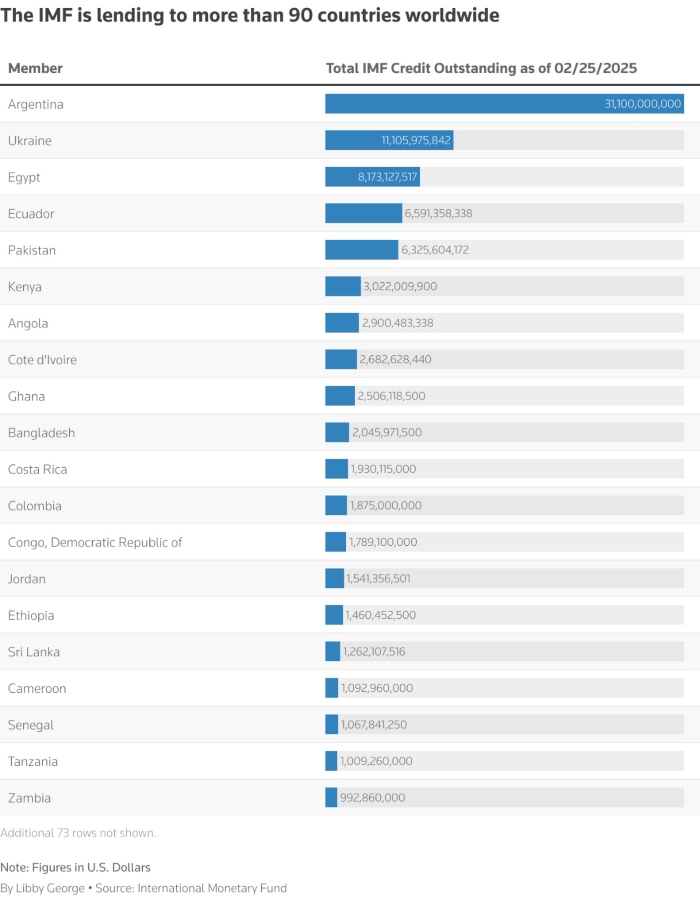

The International Monetary Fund is an lending in the last resort to countries that are exposed to problems – from Greece during its financial crisis, and Argentina, amid successive debts to the United Kingdom after an economic collapse in 1976.

Endowment ranges from emergency criticism to address the balance of payment crises to precautionary lines to prevent a crisis.

It suspends the terms of loans – which were sent in slices – to ensure the two countries of reforms, usually require discounts on waste spending, the most transparent budgets, corruption eradication or tax revenues. Investors use the International Monetary Fund data on GDP and growth as an operator to determine whether some debt tools linking economic performance payments give them more – or sometimes less -.

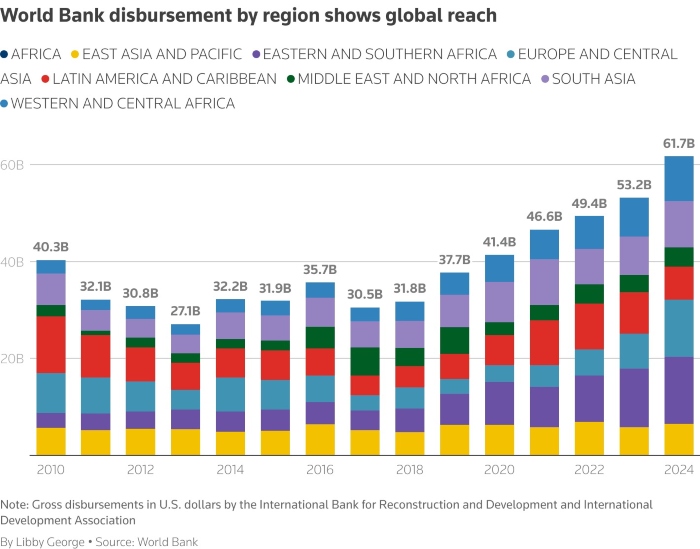

The World Bank gives low prices to help countries build everything from railways to flood barriers, creates required business frameworks for innovative financial tools, such as green bonds, and provides risk insurance.

Both lenders provide experience in issues from irrigation to the central transparency of the bank.

A group of emerging market countries depends greatly on the International Monetary Fund: Argentina has not been able to pay government workers without it, and others from Senegal to Sri Lanka are currently counting on their money.

The presence of the International Monetary Fund program also calms investors – both the private and two.

“The International Monetary Fund has long been, an anchor for debt investors specifically,” said Yerlan Syzdykov, the head of the emerging markets in the largest asset manager in Europe, adding the expertise of the United States, not just money, the confidence of investors in countries with the programs of the International Monetary Fund.

Bilateral investors, like Saudi Arabia, are increasingly viewing the International Monetary Fund as anchoring of their loans. Economy Minister Faisal Albertheim said that linking lending to institutions, including the International Monetary Fund, guarantees “greater value, from every dollar, every riyals, devoted to supporting other economies.”

Investors work closely with the World Bank’s investment arm, the International Financial Company, to participate in investing in public/private partnerships for countries that seek trillion dollars whose value is valued for cleaner and infrastructure.

It was used by developed countries that funded institutions, including the United States, to ensure global financial stability and encourage countries to adhere to the financially responsible economic models responsible.

Mark Sobel, Chairman of the IMF company, said that both the two institutions, at the request of their largest contributor, have made countries such as Egypt, Pakistan and Jordan, where the United States has strategic interests.

“If there is economic instability abroad, it may harm the American economy,” said Supple.

The International Monetary Fund often gains the anger of demonstrators to defend painful, non -popular reforms of budget budget, such as lowering fuel subsidies or raising tax revenues.

Some Kenyans condemned the International Monetary Fund criticizing during the deadly protests last summer, while the Fund was response to the Asian financial crisis of 1997.

But only a few countries, such as Cuba, North Korea and Taiwan, are not members of the International Monetary Fund.

What happens if the United States withdraws its support?

“It will be a catastrophe,” said Kaan Nazli, Neubiter Berman’s emerging market wallet manager.

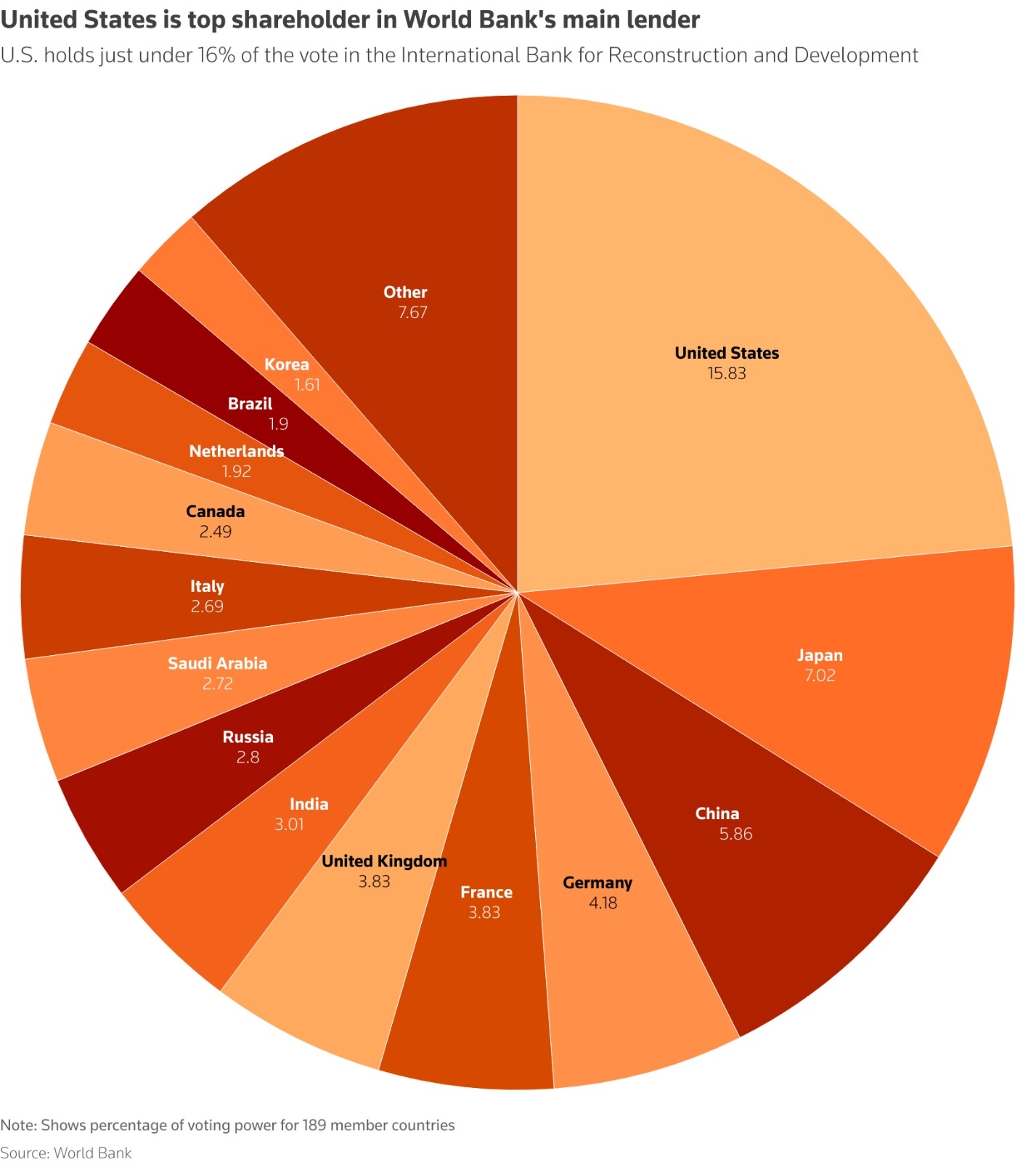

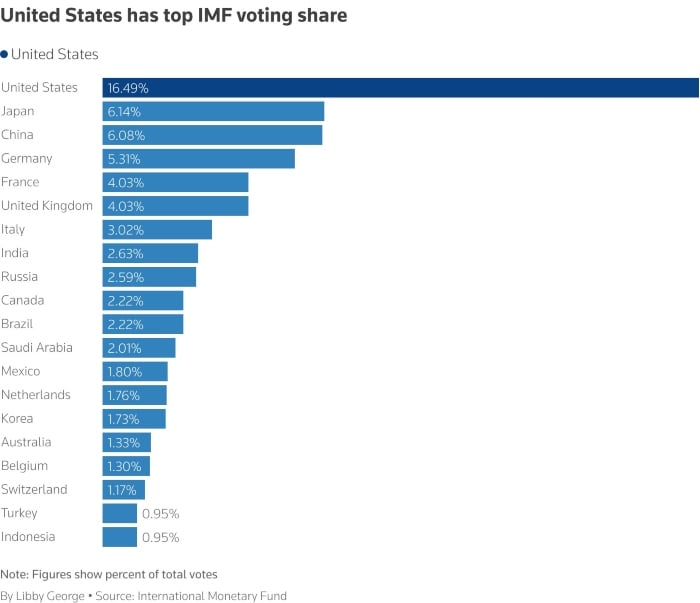

Founder member, the United States, has the largest share of each institution – slightly over 16 % for the presence of the International Monetary Fund and under that of the World Bank. Policy makers have given us a strong impact on the decision -making of global economic leaders.

The American withdrawal will also surprise experts and investors, as Washington institutions give a relatively low cost. They say that the retreating will be a gift for China and others who seek to displace it as a global leader.

Other countries can fill the financial gap; China was keen on a greater role in global groups. It prompted the reorganization of the shares of the International Monetary Fund and the promotion of emerging market sounds. The current share of China is slightly more than 5 %.

Sobel said the American exit “will be a major blow to its performance, and it will only help China.”

In the World Bank, American companies will have less access to the contracts and work that the group is funded. The change in the structure of the shareholders of the International Monetary Fund would increase the energy balance, making decisions less predictable and perhaps less transparent.

Access to experience from American Treasury officials can undermine confidence, and the classifications agencies have warned that clouds would put us in three -sided credit assessments at risk, which limits their lending ability.