The euro fell to its lowest levels in a year, reviving talk that the currency could reach the one-dollar level. Donald Trump’s victory in the US elections raises the possibility of increasing tariffs, which could deal a new blow to the euro zone economy.

At around $1.06, the euro has fallen about 5% from its highest level in more than a year in September when a weak economic outlook halted it.

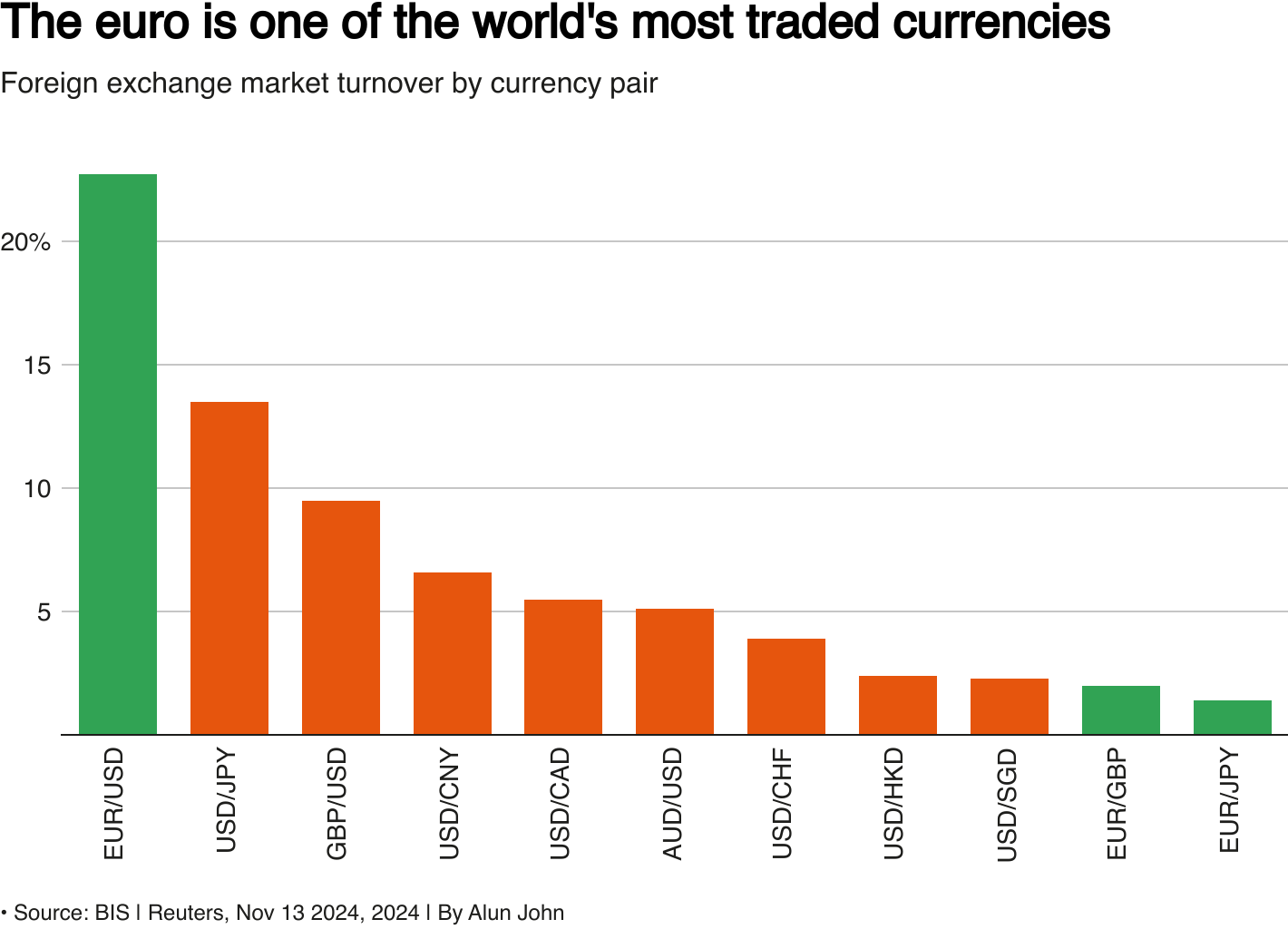

EUR/USD is the most traded currency pair in the world.

Here’s a look at what’s driving the euro’s movement and what could be next for the currency.

- Can the euro become one dollar?

This is possible. Breakeven is just 6% away, and the euro has traded below that level before — once in the early 2000s and again for a few months in 2022, when U.S. interest rates were rising faster than eurozone rates as Europe was. Struggling with rising energy prices that have led to higher interest rates. I followed the war in Ukraine.

For traders, the $1 mark is a key psychological level. So a drop below this level could exacerbate negative sentiment towards the euro, leading to a further decline.

Major banks, including JP Morgan and Deutsche Bank, believe a drop to parity could happen, depending on the extent of the tariffs. Tax cuts could also increase US inflation and limit interest rate cuts by the Federal Reserve, making the dollar more attractive than the euro.

- What does it mean for businesses and families?

A weak currency usually raises the cost of imports. This could lead to higher prices for food, energy and raw materials, exacerbating inflation.

Since hitting double digits two years ago, inflation has been declining rapidly, so the impact of a weaker currency on prices should not be a major concern at the moment. Most economists believe that inflation will return to its 2% target next year after some fluctuations at the end of 2024.

Conversely, a falling euro makes exports cheaper – good news for carmakers, industries and luxury retailers in Europe, for example, and for individuals or investors with income abroad.

This is especially positive for Germany. The German economy, long considered the European export engine, has suffered from a number of headwinds including a weak Chinese economy.

- Is the euro excluded?

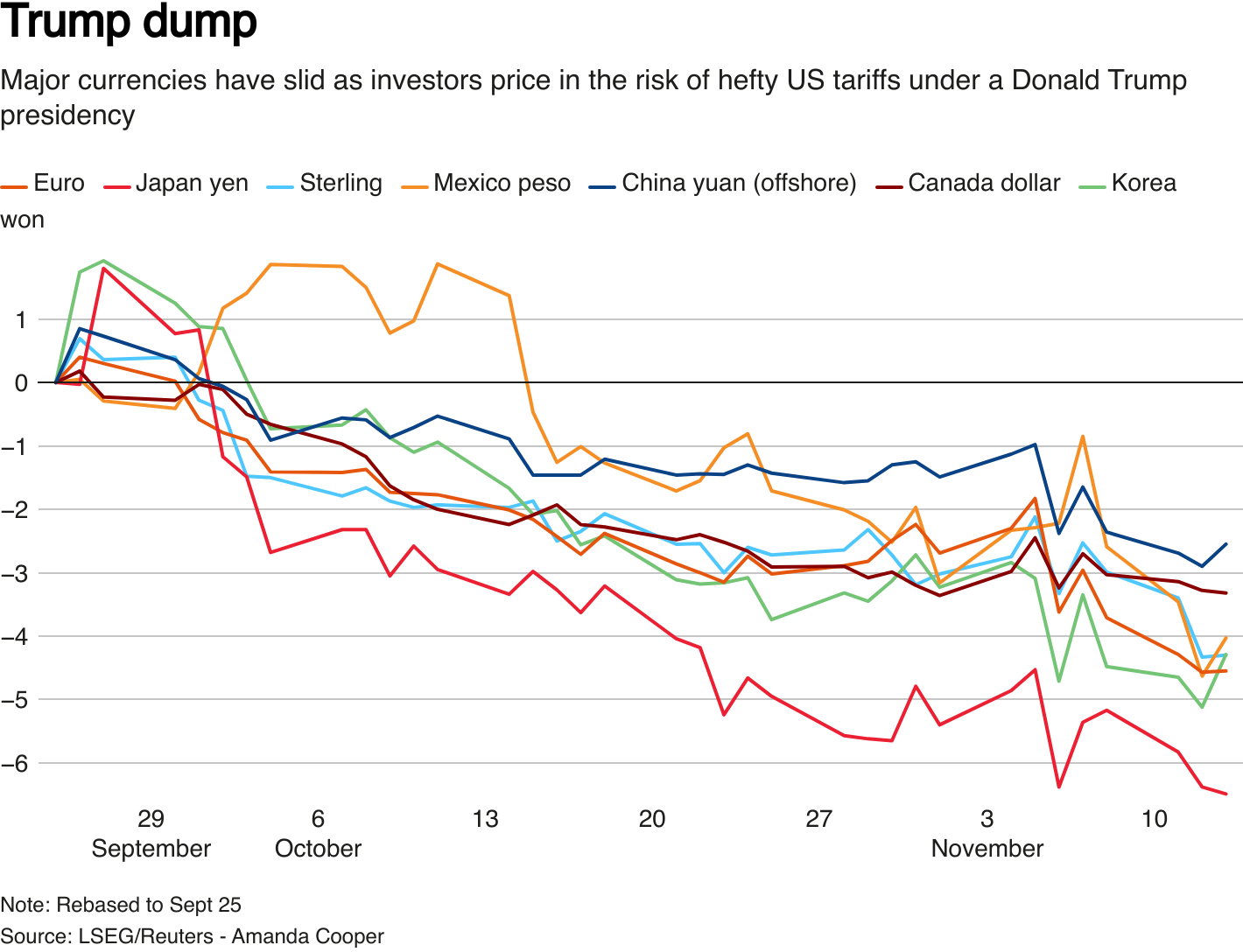

Not necessarily. The currencies of several major US trading partners have been hit hard in the past six weeks due to tariff concerns.

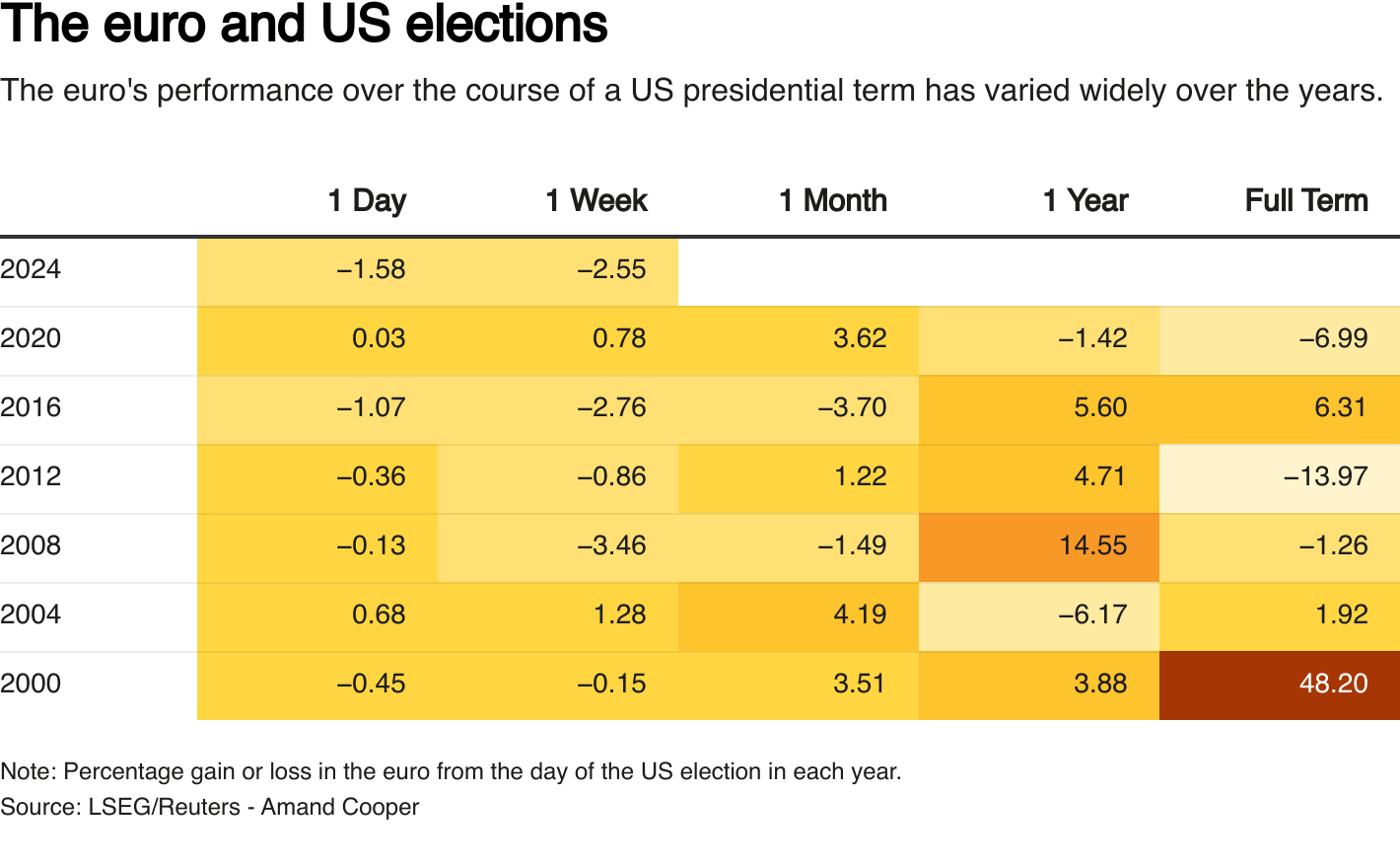

The euro lost 4.75%, while the Mexican peso lost nearly 5%, and the Korean won fell 5.4%. In fact, the euro rose by 6% over the course of Trump’s last term, but fell by about 6% in the six weeks following the 2016 result, before recovering.

And look at the Japanese yen. It’s down about 9% this year against the dollar. The euro fell by less than half that amount.

- Is it really that bad?

Not everyone has a long-term bearish view of the euro. Many banks believe that parity is possible, but not necessarily likely.

Lowering interest rates by the European Central Bank faster than the US would have a negative impact on the euro, but on the positive side easing could also support the currency in the longer term by boosting economic growth expectations.

The eurozone economy grew by 0.4% in the third quarter compared to the previous three months, faster than expected, which is positive for the euro. The collapse of the German government, which is likely to pave the way for growth-enhancing spending in the coming period, could also be supportive.

“Everyone is pessimistic about Europe and we understand the gloom but we could have some positive surprises,” said Edmond de Rothschild, CIO Benjamin Millman, adding that he did not see a significant decline in the euro from here.

- What does this mean for the European Central Bank?

The ECB is in a better position than the last time the euro weakened sharply — that was in 2022 and inflation was rising, so the euro falling below $1 increased pressure on the central bank to raise interest rates.

Fast forward to today and inflation is trending down. There are other reasons why a drop to $1 is not a major concern for the ECB.

The European Central Bank is paying more attention to how the euro performs against a basket of the currencies of the euro zone’s main trading partners. If we look at it this way, it doesn’t seem so weak. The trade-weighted euro fell about 1.25% last week and is well above levels seen in 2022.

Economists also point out that the transmission from currency movements to inflation is relatively small, so euro weakness should not stall interest rate cuts for now.