The market is expected to maintain a positive trajectory, supported by continued monetary easing, deflationary environment, and improving macroeconomic fundamentals, according to AKD Securities Limited.

Investors are expected to focus on the upcoming inflation data and Monetary Policy Committee decision next month

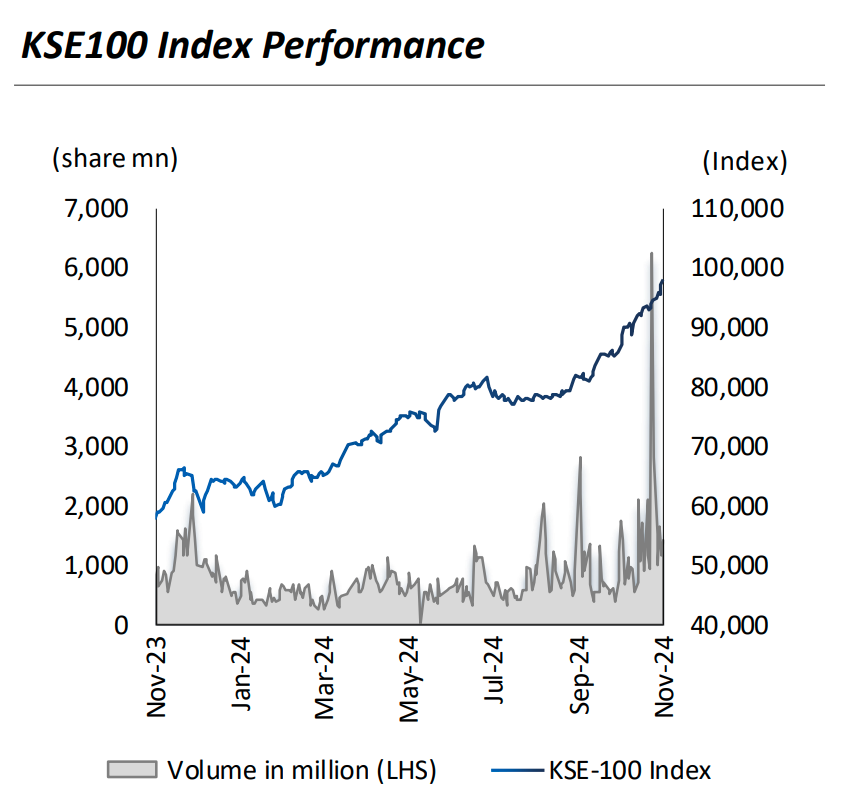

The Pakistan Stock Exchange (PSX) concluded the week on a strong note, with the KSE-100 index hitting an all-time high of 97,798 points, registering an increase of 3.2% or 3,035 points on a week-on-week (WoW) basis.

On Friday, the index reached an intraday peak of 99,630 points, falling below the 100,000 level. The market’s upward momentum was driven by strong performance in the banking and fertilizer sectors, which collectively added 2,839 points to the index.

The fertilizer sector benefited from the ongoing consolidation of Fuji Fertilizers Company (FFC) and Fuji Fertilizers Bin Qasim Limited (FFBL), with Fuji Fertilizers emerging as the best performer during the week.

Banks saw an increase in lending activity, raising their advances to deposit ratio (ADR) to 44% as of 25 October 2024, up from 39% the previous week. The increase is in line with banks’ efforts to avoid higher ADR-based taxes, as the government has appealed against the tax suspension order issued by the Islamabad High Court.

Bond yields also weighed on market sentiment, with the recent PIB auction recording interest rates of 13.05% (two-year), 12.50% (five-year), and 12.84% (10-year), marking the lowest levels since March 2022. In addition The positive statements that followed the IMF’s interim review eased concerns about a mini-budget, boosting investor confidence.

Macroeconomic indicators provided further support, with the current account recording a surplus of $349 million in October 2024, resulting in a cumulative surplus of $218 million in fiscal year 2025 compared to a deficit of $1.5 billion in the same period last year.

Average daily trading volume rose 13% to 991 million shares, reflecting improved market participation. The State Bank of Pakistan’s foreign exchange reserves increased by $29 million, reaching $11.3 billion as of November 15, 2024.

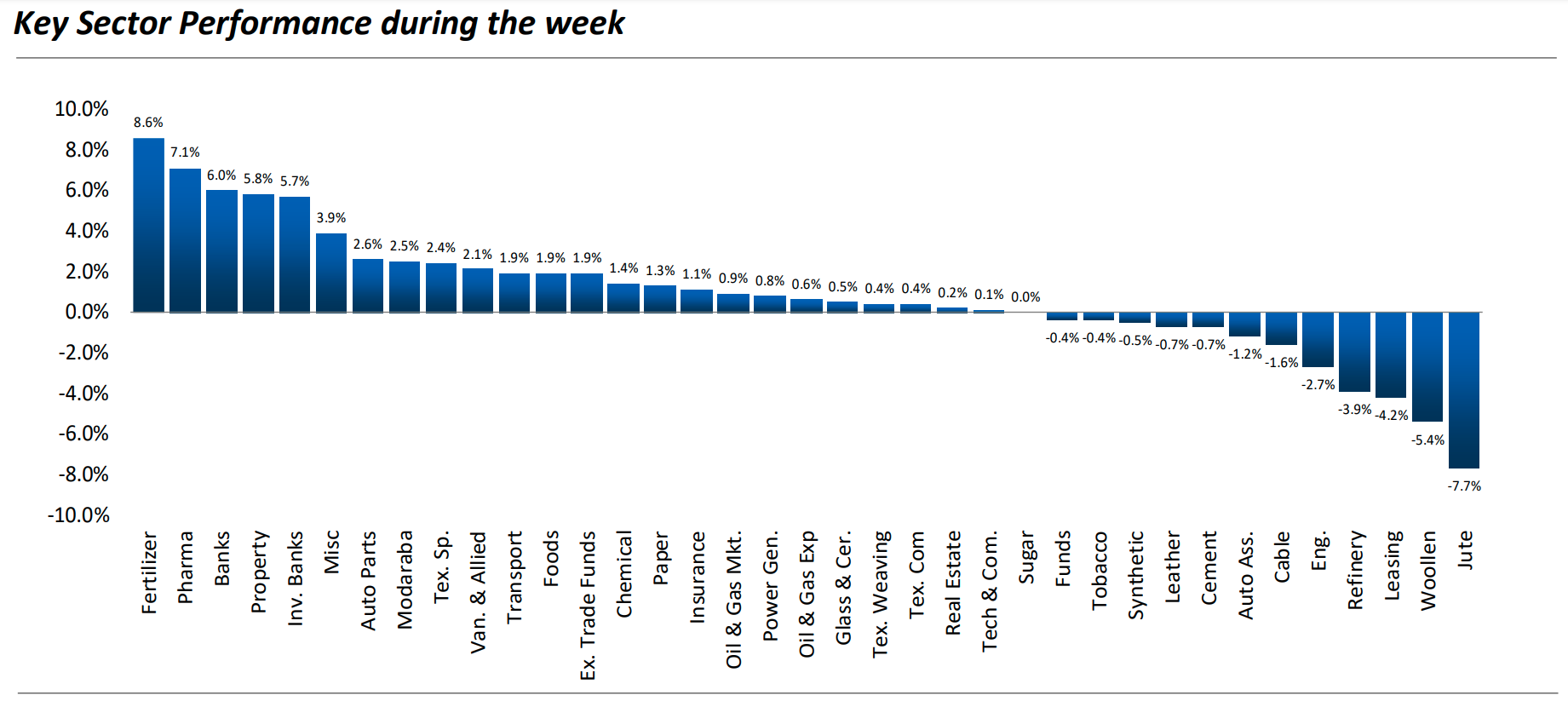

In terms of sector, Fertilizers (+8.6% YoY), Pharmaceuticals (+7.1% YoY), and Banks (+6.0% YoY) were the best performers. Conversely, the jute (-7.7% y/y), wool (-5.4% y/y), and rental (-4.2% y/y) sectors performed poorly.

The best performing stocks included PSEL (+19.6% y/y), KAPCO (+18.5% y/y), GLAXO (+17.9% y/y), FFBL (+15.6% y/y), and FFC (+15.4% y/y). annual basis). The main laggards were NCPL (-15.0% y/y), HCAR (-10.3% y/y), SEARL (-8.2% y/y), TRG (-7.2% y/y), and PKGP (-6.9% on an annual basis).

Currency markets witnessed marginal changes, with the dollar index rising by 0.79% year-on-year to 107.53. The USD/PKR rate remained stable at 277.76, while the euro fell against the dollar, with EUR/USD down 1.16% year-on-year to 1.042. Likewise, GBP/USD fell by 0.77% to 1.252. In contrast, the Japanese yen showed a slight decline, with USDJPY rising 0.28% to 154.73.

Global indicators achieved mixed results. Pakistan’s KSE-100 index led gains with a 3.2% increase, while India’s Sensex rose 1.98% and Britain’s FTSE 100 rose 2.23%. Commodities witnessed upward trends, with Nymex West Texas Intermediate crude rising by 4.74% year-on-year, reaching $70.20 per barrel, and gold rising by 4.83%, reaching $2,687.18 per ounce.

AKD Securities predicted that with monetary easing, improving macroeconomic indicators, and declining fixed income yields, stocks remain an attractive asset class. Top picks include FFC, HBL, MCB, OGDC and PPL, as investors look for continued market positivity.