Let’s start this with a question – Twenty years ago, when young professionals started their first job or when small business owners went to open their first bank account, how would they know which bank to give their business to? The primary factors they may have considered at the time were which banks would charge lower fees and interest rates, which bank had better trained staff, and which bank might offer better security, discounts, and services. Realistically, in Pakistan, another concern might have been which bank was located near a person’s home or place of work – considering the fact that at that time this concept “Kam sir ho original branch sai ho ja.”

A lot has changed since then. For most people who sign up for financial services today, the most important factor in deciding which bank to choose is how easy and reliable the bank’s mobile app is. This is because as the country’s “underbanked” population grows, the demographics of people who need financial services are also changing. This means that there are new priorities. For most people, fast and simple transactions via a trusted mobile app are key.

Change of scenery

In today’s fast-paced world, digital banking has emerged as a cornerstone of the financial services industry. Pakistan is a growing consumer market for smartphone technology and mobile data Internet connections. Although digital transformation is in its early stages, the country’s 3G and 4G penetration rate stands at 35.21%, meaning more than 74 million subscribers are connected – numbers that should continue to swell. Over the past few years, this accessibility has meant that mobile app banking has become more popular as well.

Collectively, banks and EMIs processed 844 million retail payments worth PKR 128,470 billion during the quarter. Perhaps most telling is that 47% of these transactions were money transfers, while 6% were bill payments and mobile recharges, indicating the importance of digital banking.

It is clear that as technology continues to evolve, the importance and significance of digital banking cannot be overstated. Digital banking has become indispensable in contemporary society and offers multiple benefits. Conversations with customers reveal a pattern in which the most important factors include:

- Accessibility and comfort

- Improved user experience

- Cost efficiency

- Security and fraud prevention

- Financial inclusion

The rise of digital banking aligns with the changing behaviors of consumers, especially younger generations who are accustomed to technology. Millennials and Generation Z prioritize convenience, speed, and digital solutions, making them more inclined to use digital banking. As consumer expectations evolve, banks must adapt to remain competitive, leading to a broader industry shift toward digital-first strategies.

UBL digital revolution

In an era where technology is reshaping the financial landscape, United Bank Limited (UBL) is emerging as a leading force in the digital banking sector. With a strong strategy focused on innovative digital solutions, UBL has quickly emerged as one of the fastest growing digital banks, catering to technology-savvy customers who require convenience and efficiency.

Click here to follow the link to the UBL Digital website

UBL’s digital drive focuses on offering unique products while maintaining high quality in the overall services that each bank may offer. One need look no further than the new pioneering feature offered by UBL where customers can deposit checks digitally through the UBL digital app. As a cornerstone of UBL’s vast and diverse digital landscape, UBL has transformed the cumbersome task of handling physical checks by offering these convenient facilities.

This offering simplifies transactions and reduces the risks associated with physical checks, such as loss or fraud. This innovation is especially beneficial for businesses that rely on fast and secure payment methods to maintain their cash flow.

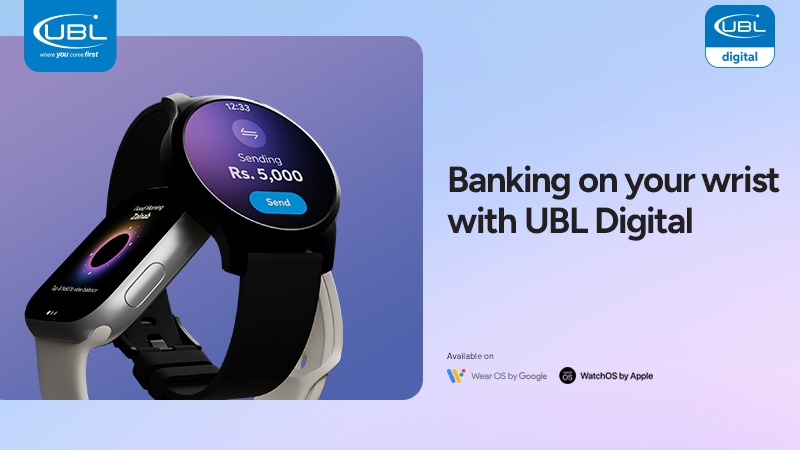

Embrace wearable digital devices

Another unique offering that UBL offers is its integration with digital wearable devices. Remember how we mentioned in the beginning that the number of digital retail transactions has risen to 83% in Pakistan? Wearable UBL is the next leap in digital banking in Pakistan. It’s a device that allows customers to easily access their accounts, check balances, and even make direct payments.

UBL’s commitment to integrating banking with wearable technology ensures customers stay connected to their money at all times. This level of accessibility not only improves the user experience, but is also in keeping with the fast-paced lifestyles of modern consumers.

Commitment to security and user experience

As UBL engages in these digital innovations, security remains a top priority. The bank uses advanced encryption and multi-factor authentication protocols to ensure customers’ financial information is protected against cyber threats. By prioritizing security, UBL builds trust with its users, reassuring them that their digital banking experience is not only convenient, but also secure.

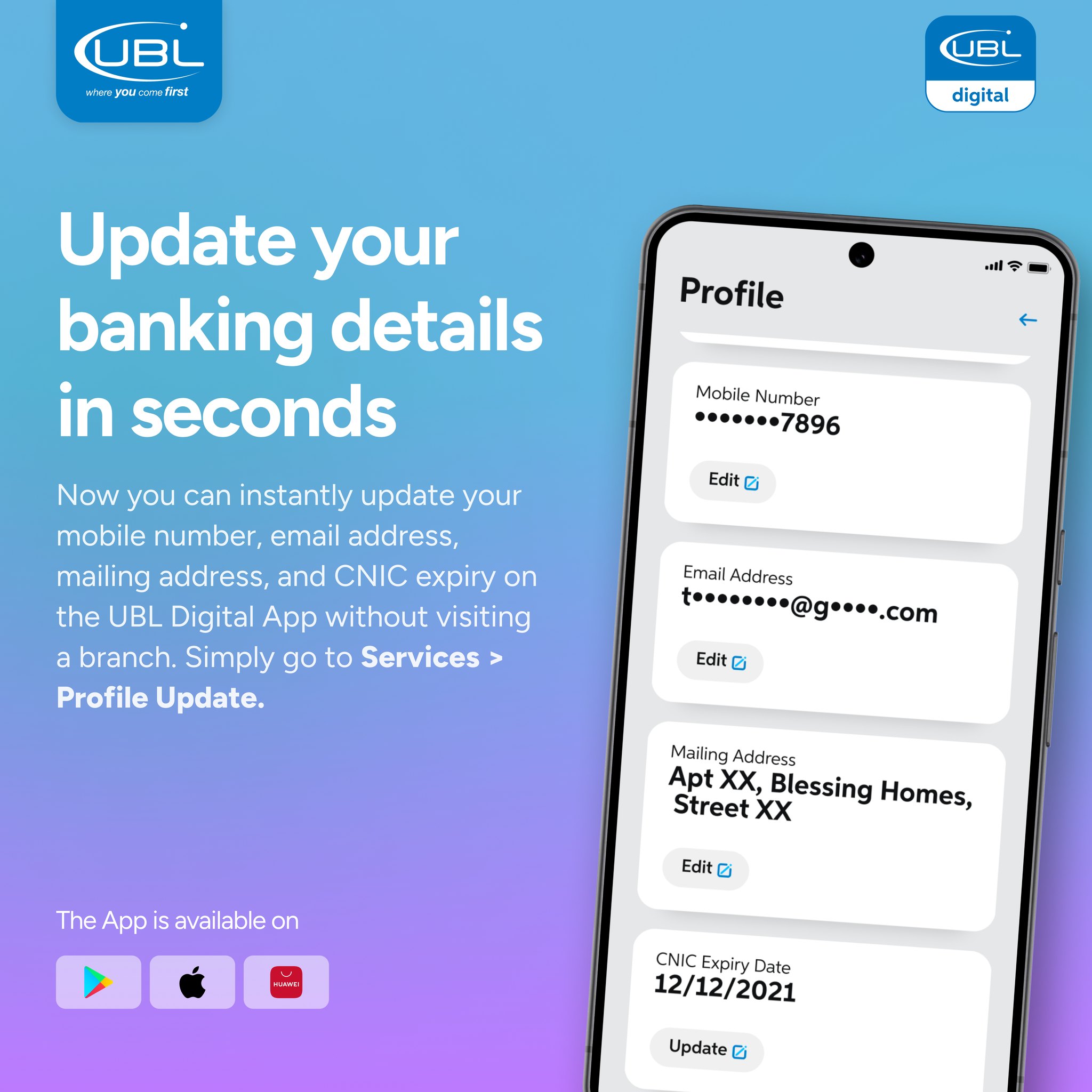

Moreover, UBL’s user-friendly mobile app is designed to enhance customer experience. The app’s intuitive interface allows users to effortlessly navigate between various banking services, from money transfers to bill payments. These multiple security features facilitate access, making it easier for users to manage their finances on the go.

UBL is at the forefront of the digital banking revolution, providing innovative solutions that meet the needs of modern consumers. As the financial world continues to evolve, UBL’s commitment to embracing technology while prioritizing security and user experience positions it as a leader in the digital banking sector. For those looking for a modern banking experience that combines speed, convenience and cutting-edge technology, UBL is undoubtedly the best and fastest emerging digital bank, redefining what banking can be in the digital age.